ATTENTION HOMEOWNERS!

You May Be Eligible for Mortgage Protection Coverage Starting at Just $3/Day

Quick & Easy Qualification

No Medical Exam Required in Most Cases

Peace of Mind for You and Your Loved Ones

Click below to find out if you qualify and get your free quote today!

"Peace of mind starts with protection — security is a priority, not a choice."

Traditional mortgage protection only provides a death benefit to pay off your home if you pass away. The new, Kind evolved mortgage protection includes Living Benefits—so whether you pass away or experience a serious health event such as a stroke, heart attack, cancer, kidney failure, or a disabling injury, you and your family can still receive financial support when it's needed most.

"We have proudly helped thousands of families across the United States secure reliable coverage for themselves and their loved ones."

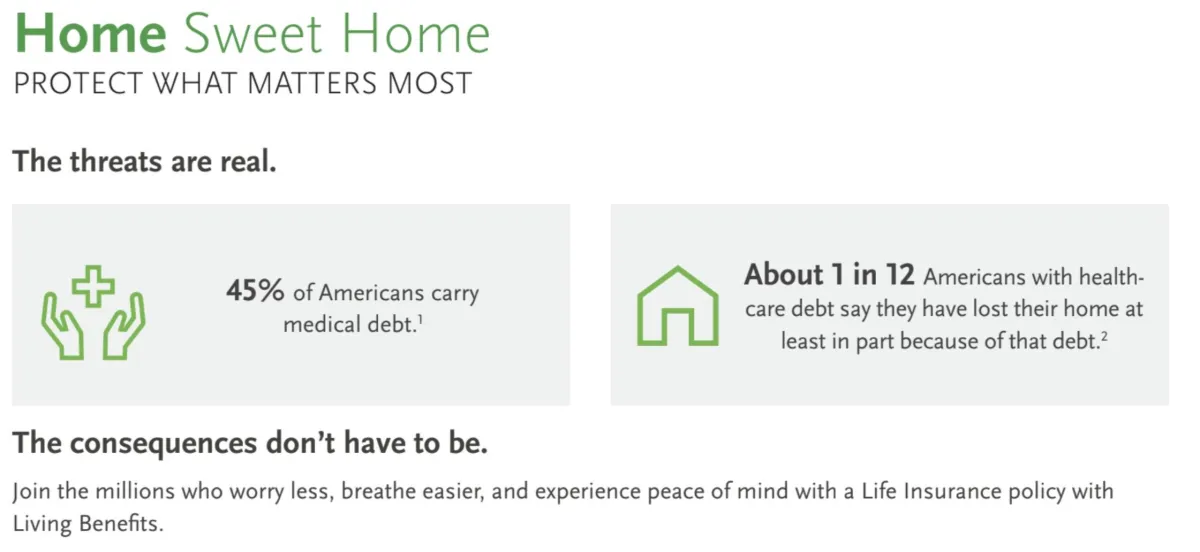

Here's Why Mortgage Protection Matters

Mortgage Foreclosures

50% of foreclosures stem from illness-related financial hardship, versus just

3% from death.

Families lose homes when income stops but medical bills continue.

🗣️ Here's What People Are Saying

Real Stories. Real Payouts. Real Peace of Mind.

Discover how much money families have received through their

Mortgage Protection coverage — with Living Benefits

that paid out when they needed it most:

testimonial #1

The Thomas Family Thoracic Cancer Received 343,000

"All that stress just evaporated instantly."

When Amanda Thomas was diagnosed with thoracic cancer shortly after delivering their fourth child, her family’s world was turned upside down. She would spend ...

THE THOMAS FAMILY

testimonial #2

The Hay Throat Cancer Received 30,000

"It saved the house and saved us financially."

Jim Johnston was healthy – he surfed, he golfed, and was active. He had no reason to think he was going to get diagnosed with cancer. When he discovered a lump under his jawline while shaving, his world was changed in an instant. Watch as Jim and his wife Anne relive his unexpected throat cancer diagnosis, and how his Living Benefits life insurance policy ultimately saved them from financial disaster.

THE HAY FAMILY

testimonial #3

Breast Cancer Received 300,000

“You don’t know what’s around the corner.”

Cornelia Steinberg didn’t think she needed life insurance. Her ex-husband earned good money in his job, and she figured that if anything ever happened to her, her daughter would be well taken care of. However, once Cornelia’s friend and adviser explained the reasons that owning Living Benefits life insurance made sense for her, Cornelia immediately saw the value as a “no-brainer”. A few months later, that decision proved to be, as she says in the video, one of the best she’s ever made.

STEINGERG FAMILY

“Mortgage protection provides money to help cover your home if you pass away — and with living benefits, you can access funds in case of serious illness, injury, or disability.”

Disclaimer:

UFIG operates as a marketing and referral service, not as an insurance carrier or direct provider. We connect consumers with licensed insurance agents and organizations that offer a variety of insurance products, including but not limited to life insurance, mortgage protection, and similar coverage options. The content on this site is intended for general informational use and may be subject to change without notice. UFIG does not represent or endorse any specific insurance company or policy and is not affiliated with government programs or agencies. Plan availability may vary by location. By using this website, you agree to our Terms of Service and Privacy Policy. You may be contacted by a licensed insurance agent to discuss your options in more detail.